Is MoneyLion Legit?

MoneyLion is a personal finance app built to offer accessible banking, credit, and investing tools in one place. If you’re looking for fast cash, trying to build your credit without traditional barriers, or exploring ways to grow some passive income, MoneyLion claims to check all of those boxes. But before getting into whether it actually delivers, let’s break down what it is and what it tries to do.

At its core, MoneyLion rolls together a few popular financial services:

- Instacash advances: These are small cash advances you can request without a credit check. You don’t pay interest, but there may be delivery fees or optional tipping.

- Credit Builder Plus loans: This program is designed to help users build credit while also getting access to part of the loan upfront. The rest is held in a locked account until repayment is complete.

- Mobile banking: MoneyLion offers a checking account, called RoarMoney, that includes early paycheck access, no overdraft fees, and FDIC coverage through its banking partner.

- Managed investing and crypto accounts: You can passively invest through automated portfolios. There are also optional crypto features for users comfortable with digital assets.

For shoppers comparing financial apps, MoneyLion presents itself as a one-stop solution. It’s appealing if you want to avoid hard pulls on your credit, need cash right away, or lack access to traditional banking services. You won’t get premium customer support, but you do get a wide set of financial tools without hopping across multiple platforms.

It’s also built to scale with you. Some users come in for the quick cash through Instacash, then find long-term value in the credit builder program or investing features. Others use the checking account for direct deposits and basic banking, especially if tired of big bank fees.

Still, nothing here is without trade-offs. Just because something is fast or easy doesn’t mean it’s the best deal. As we go deeper, we’ll look at how MoneyLion functions, what its loan structures actually look like, and whether the experience holds up for real users who rely on it. If you’re in the market for financial flexibility but need to avoid unnecessary risk, understanding how each feature works together is key.

How MoneyLion Works

Using MoneyLion starts with creating an account through the mobile app. It’s built for U.S. users, and you’ll need a valid phone number, a Social Security number, and a checking account to link. Setup usually takes under 10 minutes. No hard credit check is required to access most features, which is a big plus if you’re trying to keep your credit score steady.

Accessing Lion Loans and Credit Builder Plus

There are two main lending tools: the Credit Builder Plus loan and Instacash. They work differently, and understanding each will make or break your experience.

Credit Builder Plus loans are structured to help you build or rebuild credit. When you apply, you get partial funds upfront. The rest is locked in a savings account and released after you make consistent payments. These loans report to all three credit bureaus. You’ll pay a monthly membership fee and automatically drafted loan payments. The interest may be on the higher side, depending on your profile, but there’s no traditional credit check. This structure is useful if you’re struggling to access financing elsewhere and want to actively build credit month over month.

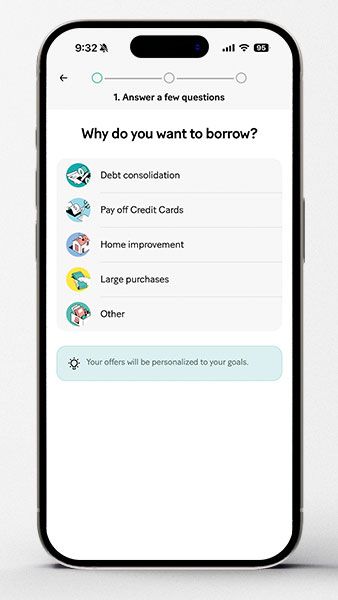

Moneylion’s Instacash product lets users get paid early after linking a checking account

Instacash Advances

If you’re just looking for fast money without taking on a loan or building credit, Instacash is designed for that. After linking your checking account and verifying income flow, you may qualify to pull small cash advances. These can be available as soon as the same day, depending on your direct deposit history and repayment reliability.

There’s no interest, but you might pay an express delivery fee if you don’t want to wait. There’s also an optional tip presented during the payout process. Many users leave a tip out of habit, but it isn’t required. Just watch your delivery settings and review charges carefully before confirming anything.

Application and Eligibility

MoneyLion doesn’t do hard credit checks for loans or advances. Instead, approval is based on several soft criteria:

- How often and how much you deposit into your linked checking account

- Your account history, including overdrafts or negative balances

- Your repayment behavior on previous MoneyLion loans or tipping history

If you’re new, expect smaller amounts at first. The system adjusts eligibility over time based on how consistently you use the platform and repay any borrowed money.

The bottom line: It’s flexible and easy to get started, but you need to stay on top of account activity, linked banking info, and repayment terms to keep everything running smoothly.

Assessing the Legitimacy and Safety of MoneyLion

If you’ve searched online about MoneyLion, you’ve probably seen a variety of opinions. Some swear by its fast cash access and credit help. Others question whether the app can really be trusted. Let’s break down what’s real, what’s just frustration, and what you need to know before handing over your financial data.

Is MoneyLion a Legitimate Company?

Yes, MoneyLion operates legally in the U.S. as a registered financial technology company. It isn’t a traditional bank, but it partners with an FDIC-member bank to offer protected checking accounts. That means the cash you store in your MoneyLion account is FDIC-insured up to the standard limits, through the partner bank—not through MoneyLion itself.

As for regulatory oversight, MoneyLion is required to comply with financial consumer protection laws like any other financial service provider operating in the U.S. It holds the appropriate licenses to offer loan products in states where it does business, and it discloses rates, terms, and fees during the sign-up process. So no, it’s not a scam—but it’s also not risk-free.

Privacy and Security Details

MoneyLion collects sensitive information including your Social Security number and banking login details. That’s expected for lending and financial services, but it’s still a major trust leap. The app uses encryption and bank-level security protocols to protect user data, including two-factor authentication and identity verification tools.

That said, your account is only as safe as your own password and linked bank security. If you reuse passwords or ignore alerts, that increases your exposure. MoneyLion’s privacy policy explains how your data may be shared with service providers or used for marketing, which is typical but worth reviewing before committing.

Common Safety Concerns

- Customer support quality: If something goes wrong, some users report having a hard time reaching quick or helpful assistance.

- Locked accounts or frozen funds: These are usually related to repayment issues or flagged activity. The app’s fraud prevention can be aggressive, and resolving issues may take time.

- Unauthorized charges or app confusion: Some users report being charged for features they didn’t realize they signed up for. Always double-check what’s active in your account settings.

So, is MoneyLion safe? It’s a legally compliant and technically secure platform, but some customers have reported an experience that isn’t always smooth. You’ll need to stay engaged with your account, monitor charges closely, and treat it like any other financial service: helpful when used intentionally, frustrating if ignored or misunderstood.

Bottom line: If you go in informed, MoneyLion is a legit tool in your financial toolkit. If you expect it to run on autopilot or offer live support like a big bank, you’ll probably hit some bumps.

Potential Benefits of Using MoneyLion

For U.S. users looking for speed, flexibility, and low-barrier access to financial tools, MoneyLion offers some unique advantages. While it’s not going to replace a full-service bank or deliver overnight wealth growth, it fills a specific gap for shoppers and side hustlers who need immediate utility with minimal red tape.

Fast Access to Cash Without Credit Checks

MoneyLion’s offers personal loans ranging from a few dollars to hundreds

Instacash stands out as one of MoneyLion’s most attractive features. If you’ve got consistent income flowing into a linked checking account, you may qualify for small advances with no interest and no hard credit inquiry. The funds can land in your account fast, sometimes within the same day. While optional tips and rush fees apply, you aren’t dealing with the typical payday loan traps. For anyone who needs a quick cash cushion before their next deposit, this is a cleaner option.

Credit Building with Predictability

If you’re trying to improve your credit but keep hitting closed doors, the Credit Builder Plus loan makes things easier. No traditional credit checks apply. The loan reports to all three credit bureaus, and your payments are structured so part of the loan is held in a savings account while the other part is issued upfront. This setup provides real credit reporting behavior, building your profile over time as long as you pay on schedule.

Perks Built into the Checking Account

- Early payday access: If your employer offers direct deposit, MoneyLion may let you tap into your funds up to a couple days sooner.

- No overdraft fees: You avoid the usual penalties that traditional banks tag onto small missteps.

- FDIC-insured deposits: Cash held in the account is protected through the app’s banking partner, keeping your funds safe up to legal limits.

Investing Without Complexity

MoneyLion doesn’t require you to know markets or study tickers. Its automated investing feature lets you passively grow funds in a managed portfolio, based on your preferences and risk tolerance. There’s also a crypto add-on, but that’s optional and not required to use the core investing tools. This setup is appealing for people who want to do something productive with extra cash but don’t want to babysit it daily.

Cashback and a Streamlined Experience

Rewards and cashback options show up depending on your account activity and partnerships within the app. While it’s not a major income stream, users focused on saving money on recurring purchases may benefit from active rewards.

Simple navigation is another plus. For users burned out by clunky banking apps or buried sub-menus, MoneyLion’s clean UI offers a more frictionless experience. Feature access is clear, account dashboards update often, and most functions are mobile-first.

If you’re looking for practical day-to-day tools with some long-term upside, MoneyLion’s benefits speak directly to that niche.

Potential Downsides and User Experience Challenges

While MoneyLion has a lot to offer on the surface, the fine print and day-to-day experience can raise flags for some users. If you’re thinking about using it to build credit, get cash quickly, or manage money passively, it’s worth understanding where users commonly run into problems.

Account Management Can Be Frustrating

A common complaint is how difficult it can be to fully delete your account or update key personal information like your name, email, or linked bank account. The app doesn’t offer a self-service way to handle major changes, so you often have to go through support channels. And if the support team is slow to respond, that delay impacts your ability to manage your finances on your own terms.

Customer Service Delays

MoneyLion is a budget-friendly platform, which often comes with trade-offs, especially in support quality. If something goes wrong—like an issue with a loan disbursement or locked funds—users report long hold times or unresponsive chat agents. It’s not uncommon to wait days for an answer on a ticket, which can be extremely stressful if money is tight or time-sensitive.

Unexpected or Confusing Charges

Several users have expressed confusion around recurring charges, especially linked to the Credit Builder Plus program. You’ll see a monthly membership fee and scheduled loan payments, but if you don’t stay on top of the billing structure, you may feel like charges appear unexpectedly. There’s also the tipping feature with Instacash and optional delivery fees. If you click too quickly or don’t review the charge breakdown, it’s easy to approve an amount you didn’t intend.

Privacy and Locked Funds Concerns

Locked funds tied to the Credit Builder loan can create confusion. Half of the loan amount goes into a locked savings account and only gets released after full loan repayment. Some users misunderstand this setup and think the funds are being withheld unfairly. Combine that with occasional account flags for suspicious activity (even when legit), and users might experience frozen access at the worst times.

Loan Costs That Add Up

The Credit Builder Loan offers structure and reporting, but it isn’t free. Between interest, monthly membership fees, and time delays in accessing part of the funds, the total cost can feel high—especially if you only need short-term relief. Since there’s no hard credit check, it’s more accessible, but that accessibility may translate into higher rates than alternatives for qualified borrowers.

Bottom line: If you use MoneyLion carefully and understand how charges, loans, and timing work, it can be a functional tool. But ignore the fine print or rely too much on customer service, and you could end up frustrated. Treat it like a financial system that requires your attention, not something set-and-forget.

Comparing MoneyLion Loans and Alternatives

If you’re sizing up MoneyLion against other financial apps, it really comes down to trade-offs. The platform offers options like Instacash and Credit Builder Plus that look appealing on paper. But how do they stack up in real-life usability and cost compared to what else is out there?

Instacash vs. Other Cash Advances

Instacash gives you near-instant funds without interest or credit checks. That keeps it competitive with other cash advance apps. But it’s not “free money.” You might pay an express delivery fee, and there’s usually a prompt to leave a tip. Other apps in this space have similar setups, but some offer more transparency around fees upfront or don’t use tips at all. Eligibility criteria tend to be similar across these platforms: direct deposit frequency, account stability, and repayment history.

- Pros of Instacash: No credit check, fast delivery (with a fee), simple to use

- Cons: Optional tip feels required, variable access limits, depends on account behavior

If you need predictable, fee-free cash advances, it’s worth comparing how other apps handle rush fees and whether they cap tips or charge monthly memberships instead.

Credit Builder Loans: MoneyLion vs. Competitors

The Credit Builder Plus loan lets you build or rebuild credit while accessing a portion of funds upfront. This hybrid model is useful if you want to report consistent payments to credit bureaus without qualifying for traditional funding. However, the monthly membership fee, automatic payments, and delayed access to part of the loan can feel restrictive.

Many competitors offer similar “secured installment” loans with the same goal: build credit month by month. What sets each platform apart is usually the cost structure and user control.

- MoneyLion: Partial funds now, the rest locked; monthly fees and variable interest; credit bureau reporting

- Others: Some offer all funds upfront, lower fees, or more flexible repayment terms

Always calculate total repayment cost including fees, not just monthly terms. If you only care about credit improvement and don’t need immediate cash, other platforms may offer similar reporting benefits with simpler repayment rules.

Which Is Better for You?

Choosing between MoneyLion and its alternatives depends on your exact needs:

- If fast cash is your priority: Instacash is handy, but compare rush fees and fund limits elsewhere before relying on it long-term.

- If credit building matters most: Look closely at repayment structure, how much you’re paying in membership fees, and how soon you get your money.

- If control and transparency are dealbreakers: Evaluate the clarity of fee disclosures across apps. Some users prefer flat-rate structures or companies with more hands-on support.

No financial app is perfect, but a smart comparison comes down to this:

- How urgent is your cash need?

- How much are you willing to pay in memberships, interest, or tips?

- How well do you manage repayment schedules and account settings?

MoneyLion holds its own as a one-stop option with moderate access for low-credit users. But if your situation is more specific—like needing a bigger advance, fewer fees, or more consistent support—you might find a better fit with a platform focused on just one thing.

Conclusion and Final Thoughts

MoneyLion, if used responsibly, can offer users unparalleled financial flexibility that other apps simply don’t have. Whether you’re here for fast cash through Instacash, looking to build credit with few barriers, or scouting tools that feel more flexible than your brick-and-mortar bank, this app delivers functional options. But those perks come with built-in responsibilities—and sometimes, caveats.

From a legitimacy standpoint, yes, MoneyLion is 100% real and regulated. It operates with a licensed banking partner, uses secure encryption, and complies with U.S. consumer finance laws. The checking account is FDIC-insured (through the partner bank), and the services it provides are commonly used by thousands. It’s not doing anything the industry hasn’t seen before. But it’s also not invincible to user complaints or misuse.

On the positive side:

- Instacash lets you access funds quickly without a credit check

- Credit Builder Plus can help you strengthen your score while saving

- There’s a clean, mobile-first banking platform that reduces overdraft worry

- Passive investing and reward features give your money more direction

But there are reported drawbacks:

- Customer service can be slow or unhelpful in urgent situations

- Account changes often require more steps than expected

- Locked funds and repayment requirements can feel confusing if not monitored

- Recurring fees, tips, and delivery charges add up if you’re not paying attention

So, is MoneyLion right for you? If you’re focused on transactional efficiency—fast money, small advances, basic credit help—it works. The tools function very well if handled with awareness. But if you want white-glove customer support, full loan transparency, or consistent hands-on help, there may be better alternatives. What matters most is whether you’re managing the app or letting it manage you.

Before diving in, ask yourself:

- Do I understand the costs and repayment terms fully?

- Am I willing to track my account and charges weekly?

- Is my goal speed, credit improvement, or long-term financial control?

If your answers line up with MoneyLion’s model, it can absolutely serve a purpose in your financial plan. Just don’t treat it as a hands-off solution. The more actively you use it, the more useful it becomes—and the less likely you are to get burned by miscommunication, unclear fees, or slow responses.

Leave A Comment